Monday, 10 January 2011

Automobile Insurance May Bring Undesirable Consequences

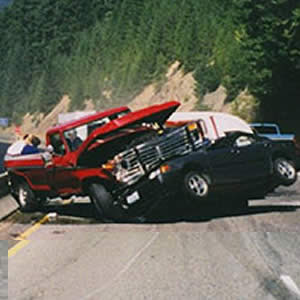

The low cost of insurance coverage for auto insurance of insurance for most non-standard minimum credit rating and a lower sensitivity to the driving activity of the applicant sold. The low cost of car insurance is almost always associated with the liability limits of low and lower quality of services. Current economic conditions are forcing many consumers to cheaper alternatives for their spending, to seek, including car insurance, and can the risk to remain in the costs for a political cost of liability insurance low reach is very expensive in case of future accidents.

Low-cost auto insurance is usually with low liability limits, perhaps the same limits as prescribed by the state. The state of Illinois requires, for example, the limits of [20/40/15, 20/40]. 20/40/15 The first two numbers means that get in an accident in the error of each victim allowed up to $ 20,000 with only $ 40,000 per accident for all injuries (in this case we speak of people in another vehicle, no car insurance). The last number refers to the total coverage per accident for property damage in this case would be $ 15,000. The second set of 20/40 means that if the insured person suffers personal injury by accident by an uninsured motorist, then will his company has more than these limits for persons caused by the insured vehicle.

Most low-cost car insurance does not cover motorist coverage, the insured similarly fails to protect against car drivers, but it applies in situations where it is not insured by someone, the insurance limits violated, but insurance sufficient to injury paid to you and the people in your vehicle.

There is a tendency among the insured limits high standard carrier demand lower prices. Decommissioning liability limits can have serious consequences for some people, the more protection and liability limits must. Whether you’re insurance is important or not to accept the lowest liability limits can have serious consequences for the assets of the insured losses have traffic accidents.

This is not to harm or interfere with the important role that low cost car insurance in our society. Programs and low-cost auto insurers play an important role not standard in our society. There are many people who are not acceptable with companies that offer high limits (i.e. international licenses, the holders of Mexican and Canadian driver's license.) Is also high-risk drivers and drivers of the United Nations to leave any way the supply of airline , the high limits are given at relatively low and thus high political importance to this type of driver, the premium can be extremely high availability. Non-standard and low-cost carrier’s auto insurance programs are very useful here and fill the void of a social necessity and economic importance.

The needs analysis is the key. The policy is the safest car you need you at affordable prices. Therefore we need an independent insurance agency, to analyze your needs and your budget and see what insurance works best for you. An independent insurance broker with a wide representation of the company can better service and advice.

Sneineh Ed is the founder of the navy, a leader in the independent insurance brokerage. The company produces dozens of insurance companies, standard and non-standard local and national level. Chicago-based company offers auto insurance, SR-22 insurance, business insurance and truck insurance in the states of Illinois, Indiana and Michigan. The company founder, Ed is Sneneh, an insurance agent since 1989, a college professor, a former insurance and finance, and is a way of accountants. The company offers a free and instant automobile, business and health systems cited on his website

Subscribe to:

Post Comments (Atom)

0 comments:

Post a Comment